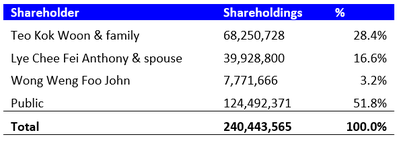

The Lim family currently controls 54.16% of Hupsteel shares. This means that it needs to receive acceptances or acquire another 35.84% for the offer to go unconditional. Incidentally, Buttermere Capital, which recently emerged as a substantial shareholder with a 6% stake acquired seemingly at an average price of below 80 cts, becomes a key player to watch here.

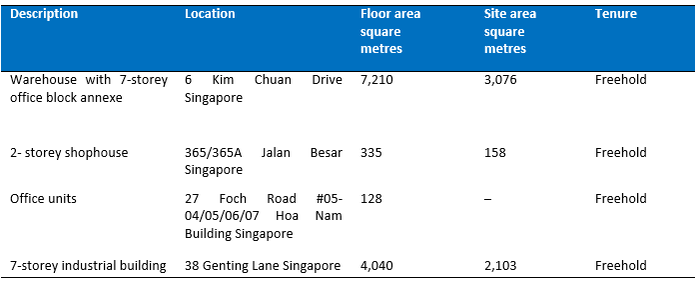

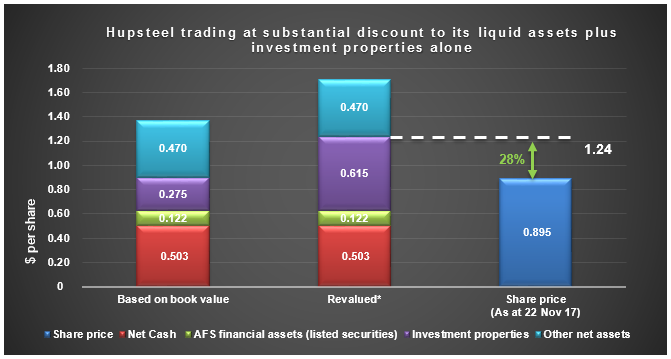

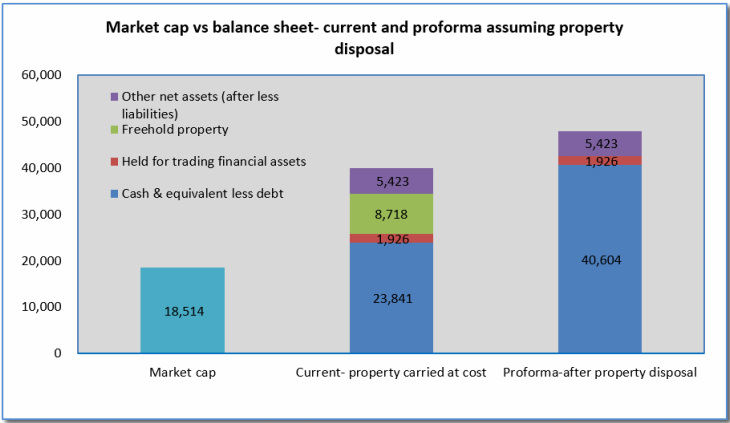

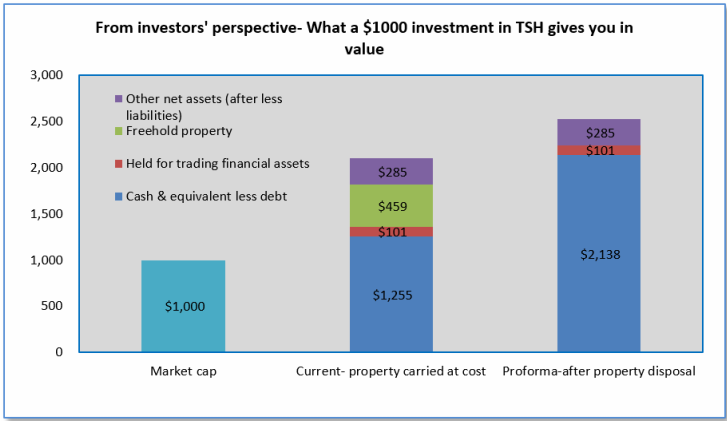

The offer price exceeds the highest price traded over the past 6 years and implies a discount of 10.7% to Hupsteel’s NAV as at 31 Mar 19. If we take into account the latest valuation of the company’s portfolio of freehold properties, the discount to RNAV would have been a less compelling 29.1%. Taken together, this means that even if the offer does not fairly reflect the true value of the company, it does provide existing shareholders an excellent opportunity to exit their investments at a price last hit when crude oil prices were still at hovering around US$100 per barrel.

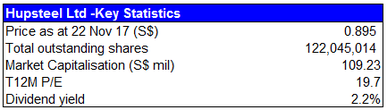

We first zoomed in on Hupsteel 2 years ago as a potential beneficiary of increased attention on then undervalued fellow steel stockist, HG Metal. We then followed that up with a strong recommendation report on the stock on 22 Nov 17 as an intriguing deep value play when the share price was at 89.5 cts, arguing that it provided better value at that time than HG Metal. At $1.20 per share and including the 4 cts dividends paid since then, the offer price would represent a total return of 38% over the 19-month period. While that does not exactly qualify as a home run, the returns are nonetheless satisfying especially when a similar investment into the benchmark STI ETF would have produced next to nothing (1%) over the same period.

More importantly, for the 3rd time in the last 4 months, after PCRD and Chuan Hup both announced big one time cash payouts, the value based investing approach that we have religiously honed over past decade and a half has once again been validated. Maybe value investing isn’t dead after all.

Related: http://stockresearchasia.com/latest-recommendations/hupsteel-ltd-discount-to-deep-value-looks-set-to-narrow

RSS Feed

RSS Feed